Maritime transport is the backbone of international trade and the manufacturing supply chain, moving more than 80% of goods marketed worldwide.

Taking a look at the international panorama, unfortunately, we note that the competitiveness of Italian container ports is rather modest. The world ‘Port Chessboard’ is in fact dominated by Chinese and Asian ports in the first place, followed by a few other ports in northern Europe and North America.

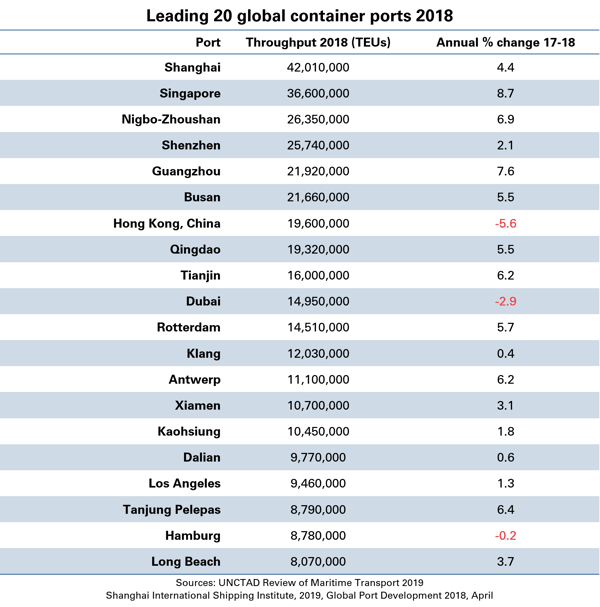

What are throughtput volumes in global ports?

According to the Review of Maritime Transport 2019, published by UNCTAD, the global handling capacity of containerized ports in 2018 increased by 4.7% compared to 2017, managing a total of 793.26 million TEU. In the same period, Italian container ports handled 10.61 million TEU, thus contributing to 1.3% of global handling (Assoporti data).

The worldwide handling of container cargo remains concentrated in certain important ports. The sum of the volumes handled in the 20 main container terminals in the world reached 347.8 million TEU in 2018, equal to 43.8% of the world in total.

Shanghai remained the busiest container port in the world, with volumes up 4.4% in 2018, while Singapore is the second largest for TEUs moved but with an increase of 8.7% compared to 2017. Among the world’s 20 main container ports, only 5 are located outside Asia, namely: Rotterdam (11th place - Netherlands), Antwerp (13th place - Belgium), Los Angeles (17th place - California), Hamburg (19th place - Germany) and Long Beach (20th place - California).

The match among the Mediterranean ports and the competition with the Northern Range

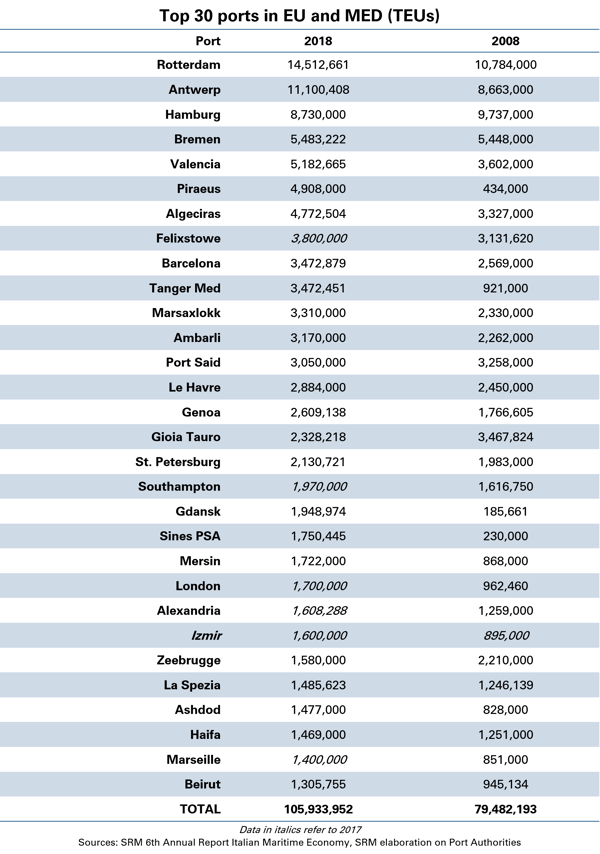

As for Europe’s international trade with the rest of the world, the game to win the volumes of incoming and outgoing goods is played between the ports of southern Europe and the much larger and more structured ports of northern Europe, the so-called Northern Range, of which the main ones are Rotterdam, Antwerp, Hamburg, Bremen and Le Havre.

As described in the SRM's 6th Italian Maritime Economy Annual Report, the Mediterranean has gained significant market share over the past decade, going from 36% in 2008 to 41% in 2018.

The main factors that have determined this increase in the competitiveness of the Mediterranean area are its location on one of the main routes of international freight traffic, namely Asia-Europe, and the doubling of the Suez Canal in 2015, which has beaten all the records in 2017 with 909 million tons transited in both directions.

Nonetheless, the Northern Range continues to largely remain at the top of the European players for the quantity of goods handled in containers.

In 2018, in fact, the exchange among Rotterdam, Antwerp, Hamburg, Bremen and Le Havre reached 42.7 million TEU against the 29.5 million of southern European ports.

The gap is even more evident if we analyze the performance of the individual ports of call: Rotterdam, the largest port in the North, moves 14.5 million TEU, while Valencia, which is the largest port in the Mediterranean, moves 5.1, slightly more than a third. Italy is even more detached, with the ports of Genoa, Gioia Tauro and La Spezia handling 2.6, 2.3 and 1.5 million TEU respectively, in 2018.

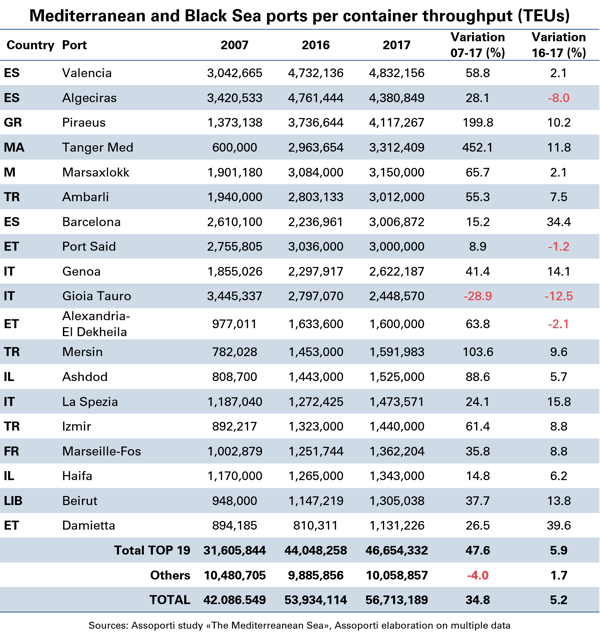

The competition with the Northern Range ports is joined by a second game in which Italian container ports are called to participate, this time against their competitors in the Mediterranean area, both European and non-European.

Taking a look at the geography of the Mediterranean basin, we find the Spanish ports to the west (in particular Valencia, Algeciras and Barcelona), the ports of Greece and Turkey (in particular Piraeus and Ambarli) to the east and the ports of Morocco, Malta and Egypt (Tanger-Med, Malta Freeport and Port Said) to the south.

If we look at the data published by Assoporti in the study "The Mediterranean Sea", it is clear that the best performances in terms of growth were recorded in the East, in particular in Piraeus and in Turkey, and on the southern shore of the Mediterranean, in particular in Morocco.

The performance achieved in the container segment by the Italian port system suggests instead that Italy has not been able to take advantage of its privileged and strategic position in the Mediterranean to attract the growing flows of goods and strengthen its market share. Indeed, Italy's market share fell by 2% in the decade 2008-2018, as shown by SRM's 6th Italian Maritime Economy Annual Report.

The main problems that our ports need to face if they want to continue playing the Mediterranean game are related to:

-

The small and medium size that characterize Italian ports and which do not match well with the growing tendency to naval gigantism

-

Natural limits, such as the generally shallow seabed that characterizes most of our coasts

-

Weaknesses in the infrastructure connections that are able to quickly transport goods from port gateways to the internal markets of Europe

The data show the Mediterranean is offering interesting developments and economic growth opportunities for the maritime sector. The enviable position of our country, combined with the specializations of our ports, the position (although precarious) of leadership in short-haul transport and the great growth potential of the intermodal network are an opportunity that would be a shame to waste.

On the contrary, practices and policies should be defined to be able to adequately exploit the great productive, economic and geographical potential that our country possesses and channel it into a logistic, port and governance system capable of making us more attractive and performing than our European and international competitors.

Contship Italia group has been investing in this direction for years, helping to create the Southern Gateway system, an alternative routing for those who transport goods on the Asia-Europe and USA-Europe routes that exploits the Italian port system and its connections by road and rail to the main internal markets of the continent.

.jpg)