Although a certain degree of normality has returned and COVID-19 case counts are gradually retreating following vaccine rollouts in numerous countries, supply chain disruptions and delays continue to persist.

The Covid-19 pandemic revealed the fragility and vulnerability of the supply chain. The obstructions originally caused by factory shutdowns and restricted workforce continued in the second half of 2020 and in the first quarter of 2021. For example, unexpected shortages of containers in Asia and bottlenecks at US and UK ports resulted in another butterfly effect on freight costs for companies and freight forwarders.

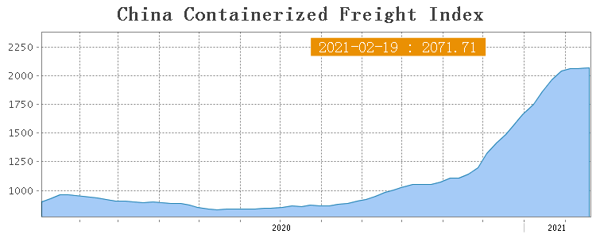

Because of surcharges and other (partially hidden) guarantee fees, the actual rate that shippers and forwarders are paying carriers had doubled in the last 12 months, as shown by the SCFI (Shanghai Containerized Freight Index) figure.

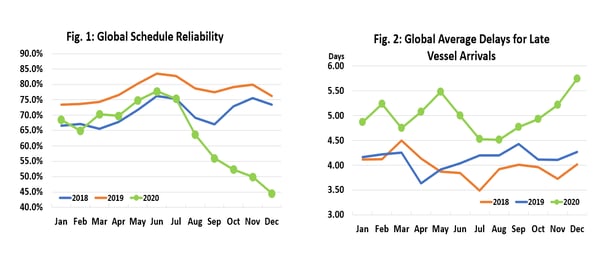

Meanwhile, deep-sea service schedule integrity has dropped to its lowest level on record according to Sea Intelligence consulting. In December 2020, only 44.5% of vessels arriving on time, a 31.7 percent decrease compared to the same period in 2019. These delays can significantly disrupt supply chains, manufacturing, operations and eventually eat into revenues and profits.

Supply chain losses often under-estimated

Although COVID-19 can be considered as a “black swan” event, companies need to realistically anticipate supply chain disruptions lasting a month or longer to occur once every 3.7 years, according to a survey conducted by McKinsey Global Institute.

Depending on the damage and frequency of the disruption, an average 44 percent of a company’s single-year profits over the course of a decade can be wiped out. However, even so, fifty-four percent of executives say they don’t have clear visibility into their supply chains beyond Tier 1. With the COVID-19 pandemic fresh in their minds, an overwhelming 93 percent reported in May 2020 that they plan to take steps to make their supply chains more resilient.

Rebalancing global value chain

Whilst there has been rising talk of bringing back manufacturing to the continent over the last decade for competitive and security reasons, difficulties and hurdles have prevented this from happening in a large way.

In the last decade, Europe tried to bring manufacturing back to the continent to boost economies, provide domestic employment and minimize national security threats. However, only 76 firms actually moved back to Europe from China between 2014 and 2018, according to the Europe Reshoring Monitor project.

During the early stages of the pandemic outbreak, the perceived wisdom in the business world has been that the pandemic-induced supply chain disruption could possibly be a driving force for reshoring. In the first half of 2020, governments such as Japan and the US launched stimulus packages to encourage reshoring.

Just in January 2021, US President Joe Biden signed an executive order to review the global supply chains in computer chips used in consumer products; large-capacity batteries for electric vehicles; pharmaceuticals and their active ingredients; as well as critical minerals used in electronics.

However, the unrivaled supply chain integration, skilled workforce, and large market size made it impossible to exit China completely.

In a survey conducted by the European Chamber of Commerce, only 11% of European companies are planning to move their manufacturing activities out of China, whereas 12% plan to diversify their supply chain by seeking alternative suppliers outside of China. Significantly, while Covid-19 did affect business decision-making, only 4% of respondents are considering moving out of China due to the pandemic.

Reshoring made possible with technology: manufacturing automation

It is likely that given significantly accelerated adoption of technology and digitization by global companies through the pandemic, solutions to solve reshoring hurdles would be far more widely adopted than before.

According to the International Federation of Robotics, to comply with safe-distancing requirements, firms have turned to the use of robotics, and other technologies to maintain productivity with a limited workforce, and the trend of smart factories will likely continue.

According to the UNCTAD 2020 world investment report, reshoring to Europe would be more adapted to high-tech firms with a deeply integrated global supply chain, and requirements for automation in manufacturing. Digitalization in manufacturing is believed to reduce labor costs, leading to reshoring certain manufacturing and create new job opportunities in higher-income emerging economies.

Supply Chain Technology

Amid the market headwinds, logistics companies are also building resilience with modern technology (cloud, digital, the Internet of Things, and data analytics). In an increasingly complex raw materials and intermediate goods flow, technologies and data analytics play a vital role in increasing logistics visibility, streamlining procurement and sourcing process, and inventory management, improving the process of fulfilling orders.

For example, blockchain allows traceability and can provide payment to linked supply chain partners after their part of a chain of linked activities has been completed. Advanced data analytics tools enable companies to identify supply chain anomalies such as delays. AI solutions empower supply chain scenario planning and implementation, optimizing supplier networks or even changing the economics of productions.

The path forward: joint investments in training

The increase in technology adoption raises concerns for the labor market – one of the biggest fears is that AI tools, machinery, and remote digital services robots will take away jobs even if the factories move back. According to Eurostat, unemployment across the whole of the European Union rose to 7.5% in December 2020, with the youth unemployment rate stood at 17.8%.

As such, it is crucial for all stakeholders in both public and private sectors to work hand in hand together to ensure all workers and healthy businesses can keep up with this rapid transformation.

In November 2020, the EU officially launched The Pact for Skills, calling on the industry, employers, social partners, chambers of commerce, public authorities, education and training providers, and employment agencies to work together and make a clear commitment to invest in training in improving existing skills (upskilling) and training in new skills (reskilling) for all working-age people.

Initiatives under the pact, including European Social Fund Plus (ESF+ under shared management), Just Transition Fund (JTF), are expected to draw 2 billion euros in public and private investment to train more than 250,000 workers and students in Europe’s electronics sector.

The Made In Europe Partnership is also taking the lead in transitioning manufacturing with proper consideration of the well-being of workers and society. Achieving these principles will require a further digital transformation of the manufacturing industry, encourage human-robot collaboration, ensuring that digitization keeps the well-being of individuals and the community at the center.

To deliver on its goals by 2026 and equip workers with higher technological skills, EIT Manufacturing is also committed to educate, train and re-skill 50,000 people.

Building resilient supply chains and workforce

In a challenging and constantly changing context, the Contship Italia Group remains firmly committed to doing its part, contributing to the resilience of the supply chain, through investments and innovations in its network of terminals and intermodal services. We do so with the aim of offering carriers, shippers, and companies quality logistics services, which are essential for maintaining highly efficient and sustainable connections between production and consumption markets.

.jpg)