Trucking represents one of the main pillars of the logistics sector. road haulage offers speed and flexibility, two important elements for the supply chain of manufacturing and retail companies. Over short distances, trucking often represents the only effective option for freight transport, while for long distance transport the indiscriminate use of trucks generates substantial negative externalities, which may be reduced through a smart use of combined transport.

The railway should not be seen as purely alternative to the road; the truck remains a central element in the combined transport model, which uses road vehicles intensively, to serve intermodal terminals through shorter and frequent trips, necessary to provide first mile and last mile connectivity.

In this article we collected some relevant data, which are helpful to describe the competitive landscape of the Italian trucking sector, together with some considerations regarding the main challenges currently faced by the system.

Facts and figures about trucking in Italy and Europe

Within the European Union, three quarters of the total freight transport is performed by road (76.4%). In Italy, the share of trucking is even higher (85.5%). (Eurostat data)

More than 13 million heavy goods vehicles are on European roads, two thirds of which are used, on average, for domestic purposes, whilst the remaining third is used for international transport, with enormous differences between countries. Heavy-duty vehicles (HDVs) account for about 4% of vehicles in circulation within the Union, but are currently responsible for 30% of CO2 emissions (ICCT data).

Three quarters of total road transport, in terms of tonne-kilometres, is performed in seven countries: Germany (18%), Poland (14%), Spain (11%), France (10%), United Kingdom (9%), Italy (7%) and the Netherlands (4%).

It should be noted that about 90% of the heavy transport activity of Italian hauliers takes place within national borders, and only 10% concerns international traffic.

The proximity to countries that are a source of competition, characterised by lower labour costs (Slovenia, Croatia, Hungary and Romania) does not help Italian operators, who recorded, between 2008 and 2016, a drop in turnover of 5% at national level, and 10% at international level.

Freight transport through the Alps

The majority of international transport activities involving Italy crosses the Alps at the borders with Austria, France and Switzerland. The modal split on these routes reflects the infrastructural differences and the strategic choices implemented by the three Countries: between Italy and France, road haulage accounts for almost all volumes (92% moving on the road, against less than 8% moving by train); between italy and Austria road haulage is still dominant, but the use of rail increases (30% of volumes moving by train); between Italy and Switzerland the share of trucking is much lower, as more than 70% of volumes are transported by rail.

The shortage of qualified drivers

One of the most pressing problems for the sector, which also involves countries such as Italy, which are experiencing a generalised decline in turnover, is the lack of qualified drivers. According to a report by the German association DSLV, two thirds of drivers in Germany will retire in the next 15 years and there is already a shortage of around 45,000 drivers, due to the fact that 30,000 operators leave the profession every year, whilst only 2,000 people obtain, in the same period, a professional qualification for driving heavy vehicles. The situation is equally severe in France, with a shortage of about 20,000 drivers and in Italy, where the estimates of industry associations speak of at least 15,000 missing drivers.

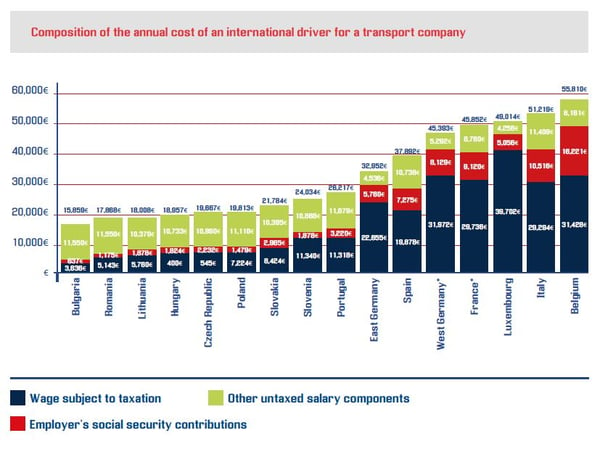

Cost of labour and operating costs of heavy vehicles

As far as labour costs are concerned, substantial differences between the various countries persist; Italy is the second country, after Belgium, where labour costs are higher, more than twice as high as in countries such as Bulgaria, Romania, Lithuania, Hungary, the Czech Republic, Poland, Slovakia and Slovenia.

This graphic shows a summary of the main operating costs of a road train. The average operating cost per kilometre is obtained comparing the total costs (excluding structural costs) to the average distance, estimated at 115,000 km/year. (source: Hannibal S.p.A.)

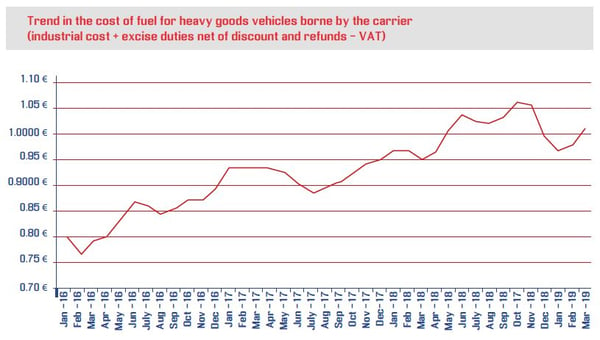

The cost of fuel, in order of importance, represents a further element of compression of operators' margins, also in virtue of the price increases recorded in recent years (+26% from January 2016 to March 2019).

Despite the price shock generated by the COVID-19 crisis, which brought the fuel price to a minimum, the historical trend suggests a constant growth of fuel price in the long run.

To learn more and take part in the discussion, we invite you to download and share the White Paper

The challenge of change

If one analyses the data collected, it is clear that the sustainability of the traditional business model of long-distance road transport is threatened on several fronts. The room for maneuver is becoming increasingly narrow and many of the classic cost-containment strategies (wage compression and the use of low-cost labour, social dumping and lengthening of the life cycle of vehicles) are no longer feasible, even in light of new, stringent regulations and a general evolution of sensitivity in this area.

From problems to solutions

The crux of the matter remains the need to redistribute heavy goods traffic, limiting long-distance journeys as much as possible and exploiting the flexibility of the road carrier to effectively serve first and last-mile distribution, whilst at the same time improving the availability, speed and quality of intermodal rail services, which already currently represent a reliable and sustainable alternative to all-road transport, on the leading national and international routes.

To make this modal shift possible, it is necessary to take inspiration from the realities that have successfully undertaken this path, obtaining concrete results. This is the case of Switzerland, which in the last 25 years has shifted a significant share of freight traffic from road to rail, thanks to a combination of innovative policies and funding that encourage and facilitate the conversion, reaching in 2018 an enviable ratio 72/28 between rail and road, for transalpine freight traffic.

The role of public opinion, corporate social responsibility and policy-makers

The growing attention to sustainability issues understood not only as attention to environmental issues but as a long-term approach to economic and social development, requires an acceleration of the change taking place, also in other European countries. As highlighted at the beginning of this report, the transport sector is responsible for a share of emissions and negative externalities, but is at the same time, one of the pillars of economic development, and a vital element of the trading economy, which ensures prosperity and development to the entire European continent. For this reason, the challenge of developing the system must be seen as an indispensable, concrete opportunity within the reach of governments, operators and the most far-sighted carriers.

For national and EU policy-makers, it is essential to open a constructive dialogue with the world of industry, representatives of road haulage companies and the world of logistics, with particular attention to the demands of intermodal operators, which are already currently engaged in the commercial development of railway alternatives dedicated to combined transport. Politicians have the task of stimulating a genuine and factual debate on the need to pursue substantial infrastructure development; at the same time, the right incentives must be introduced to direct investment towards the most sustainable modes of transport, making solutions that reduce road congestion, pollution and the negative externalities of road abuse increasingly competitive.

Hauliers have a responsibility to assess, with due foresight, the sustainability of the transport model proposed to the market, rejecting practices such as social dumping and cutting costs related to the safety of operations and proper management of the fleet and staff. Overcoming only downward competition, specialising in serving niche markets sensitive to innovation, energy efficiency and service quality, can be a winning strategy to ensure growth in the medium and long term. In doing so, however, companies cannot be left alone: it is necessary to support them by developing - amongst customers and end consumers - a greater awareness of the risks associated with excessive compromises linked to the search for the lowest possible price, the expectation of ever-faster deliveries and "zero cost".